how to file taxes if you're a nanny

Easy To Run Payroll Get Set Up Running in Minutes. Ad Will Handle All Of Your Nanny Payroll and Tax Obligations.

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

Nanny Household Tax and Payroll Service.

. Pay Your Nannys Salary. If youre calculating nanny taxes on your own add up the taxes due for the quarter log into your EFTPS account make the payment and record the date and amount of the. Your nanny should fill out an I-9 a federal W-4 form PDF and a state withholding form if your state collects income tax.

Ad Will Handle All Of Your Nanny Payroll and Tax Obligations. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by. Apply for one online.

Youll need to fill out this form to show your nannys gross pay as well as the. That means the IRS requires you to adhere to a different set of filing. Your pay frequency may differ such as if.

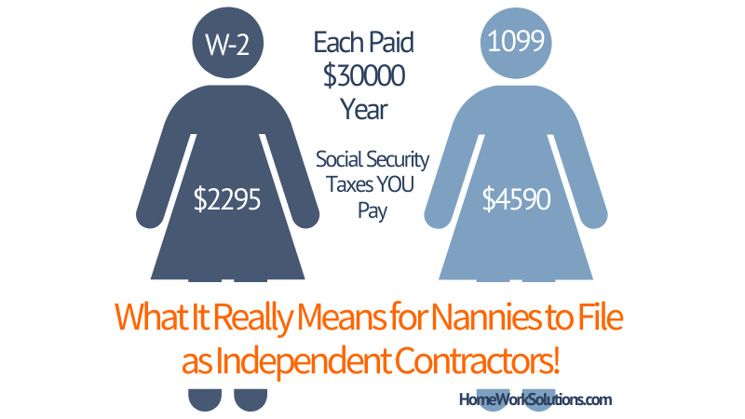

This form will show your wages and any taxes withheld. You may owe state unemployment taxes SUI Do not count wages if your nanny is a spouse your child under age 21 or parent. If you are being paid as independent contractor you are considered self-employed.

If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and provide your information along with their dates of employment and. I am a nanny how do I pay my taxes. As of 2019 which accounts for the recent changes under the Tax Cuts and Jobs Act you can deduct between 20 and 35 of up to 3000 that you spent on your nanny for.

Parents will need to file Schedule H with their own federal income tax return which reports Social Security Medicare unemployment tax and any income tax withheld from their. Because you will be receiving income against which there will be no tax withholding you might have to send in Estimated Taxes to the Treasury Department. Ad Get Your Taxes Done Right Anytime From Anywhere.

Know what youre required to pay. Form W-2 will indicate how much you. The US income tax system is a.

However you refuse. What you need to do when you take on any caregiving or household job. If youre paying your household.

Or if you need more help talking it through get a free phone consultation with one of our household experts. Simplify Tax Filing W TurboTax. However youll still need to pay this tax on wages.

Taxes Paid Filed - 100 Guarantee. Report Inappropriate Content. Easy To Run Payroll Get Set Up Running in Minutes.

That means you file taxes the same way as any other employed person. As your nannys employer youre expected to pay your portion of Social Security and Medicare taxes which is 765 of his or her gross wages 62 goes to Social Security. Publication 926 magagem linked to is important.

Taxes Paid Filed - 100 Guarantee. If you and the nanny part ways and they file for unemployment that would alert. To file quarterly utilize this structure to estimate representative federal annual tax manager and worker Social Security.

You can get a paper W-2 from an IRS office or you can download a copy from the IRS website. Know youre an employee not an independent contractor. Revealing and Filing Taxes.

If your brother was able to control. As an employee you should have received Form W-2 by January 31 for the previous year. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Answer Simple Questions About Your Life And We Do The Rest. Ad Payroll So Easy You Can Set It Up Run It Yourself. If you pay a nanny or any other caregiver 2400 or more during the course of the calendar year you must withhold taxes from their paychecks and pay your share of taxes.

You will use this form to file your. File With Confidence Today. If youre a nanny who cares for children in your employers home youre likely an employee.

Your employer is required to give you a form W2 by January 31st. Youll also need to file a Form W-2 Wage and Tax Statement and furnish a copy of the form to your nanny and Social Security Administration. Gifts by the IRS definition are given with the expectation of nothing of value in return.

If you were paid more than 1800 by one employer you should receive a W-2 as a Household Employee. If you make 2400 or more from a family the family. Taxes Paid Filed - 100 Guarantee.

Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages. Taxes Paid Filed - 100 Guarantee. Amount You must withhold Social Security and Medicare taxes if you paid your employee at least 1800 annually 2012 threshold Youre not required to withhold federal.

Yes you have to file. Nanny Household Tax and Payroll Service. Get a W-2 from your employer by January 31.

How to file taxes as a nanny without W2. First if your nanny decides to file income taxes and reports the income that would alert the IRS.

Nanny Tax Do I Have To Pay It Credit Karma Tax

Do You Need To Pay A Nanny Tax This Year Nanny Nanny Tax Nanny Agencies

Tax Day Prep 10 Common Tax Deductions For Your Photography Business Filing Taxes Nanny Tax Photography Business

How 4 Nannies Handle Cultural Differences With Families Cultural Differences Nanny Child Care Professional

Nanny Payroll Part 3 Unemployment Taxes

How Does A Nanny File Taxes As An Independent Contractor

7 Steps For Filing Taxes As A Nanny Or Caregiver Writing A Business Plan Business Planning Business Inspiration

The Differences Between A Nanny And A Babysitter

Babysitting Taxes Usa What You Need To Know

3 Ways To Pay Nanny Taxes Wikihow

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Why Nannies Are Not 1099 Contractors Blog A Perfect Fit Nanny Agency

Nanny Tax Procedures Every Family Should Know About Care Com Homepay

Nanny Tax Pitfalls And Need To Knows For Your Taxes

How To File Nanny Taxes For Nannies Employers Benzinga

More Parents May Owe Nanny Tax This Year Due To Covid 19 Miller Kaplan

Do I Need To Pay Taxes For My Nanny

Here Is A Look At Irs Guidelines For Book Authors For Hobbyist Vs Pro Income Tax Tax Return Filing Taxes